Are Passive Investments as Risky as Hedge Funds?

A recent CNBC commentary argued that hedge funds are a risky bet, largely because the sector has trailed the S&P 500 index for five years, as well as the fact that it is hard to identify managers who can perform well. The suggestion by one of the quoted experts...

Signs of Better Days Ahead for the Hedge Fund Sector

There's little doubt that the hedge fund sector has not been performing well. As of the end of November, the HFRI Fund Weighted Composite index was up 0.3% for the year, which trails the modest gain of just under 3% in 2014. Although aggregate returns are keeping pace...

Are Funds of Hedge Funds worth the extra money?

Funds of Hedge Funds offer a professional service in manager selection, due diligence process and portfolio management. Of course this service comes at a cost, and that is on top of the standard 2 and 20 you are already paying for Hedge Fund investments. Standard FoHF...

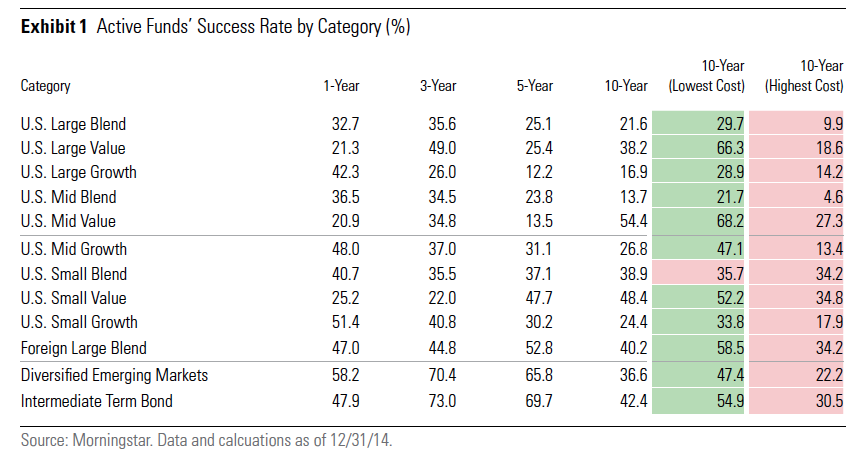

The Right Environment for Active Investing

Last Wednesday, stocks fell and the dollar rose after Federal Reserve Chairperson Janet Yellen essentially confirmed that the central bank would be raising short-term interest rates at the next Federal Open Market Committee meeting in mid-December. On Thursday,...

The Hedge Fund Smell Test

In "Hedge Fund Investing: The 4-Ps," I discussed the notion of due diligence and how investors might go about selecting a hedge fund manager. In theory, the range of criteria that can be used to make such a assessment is unlimited, which means that it could be hard to...

Hedge Fund Investing: The 4-Ps

There are various reasons why someone might want to invest in a hedge fund. The most obvious, of course, is performance, or more accurately, the prospect of acceptable future performance, however that is defined. There is no point in entrusting funds to a manager if...

Review: Online Hedge Fund Database Providers in 2019

Data vendors are useful in that they allow us to find all the data we may need in one place and usually give access to charts and statistics relevant to a specific investment universe. Here is the list of the main ones in alphabetical order, we will then take a look...

Performing Due Diligence in Manager selection

Due Diligence consists of performing a careful, competent and thorough review of an investment, its soundness and its suitability. Due Diligence aims to identify the most appropriate funds for an investor considering various tax and legal characteristics, together...

Hedge Fund Investing: A Contrarian Dream

Many commentators have voiced opinions about what is wrong with hedge fund investing. In “The Misguided Focus on Hedge Fund Fees,” for example, I discussed widespread criticisms of the fees charged by managers. But complaints about performance have been just...

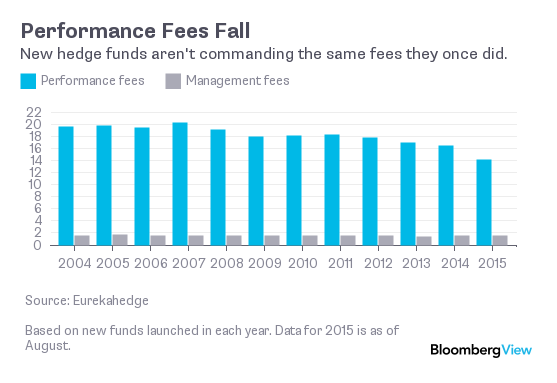

The Misguided Focus on Hedge Fund Fees

Few doubt that billionaire Warren Buffett is a smart man and a savvy investor. But he is also a hypocrite when it comes to the subject of hedge fund investing. At the Fortune-sponsored Most Powerful Women Summit in October, he criticized the hedge fund industry, most...