- Phone : +1 877 936 7175

- URL :

- Global Rating

- Very Good

User Rating

- 3 Reviews

Launched in 2015, BitcoinIRA was the world’s first full-service Bitcoin IRA investing solution in the United States. Today, retirement investors interested in self-directed cryptocurrency trading and investing within an IRA can take advantage of BitcoinIRA’s 24/7 online platform and app—all within a low fee structure and a sleek user interface.

Pros:

- The original pioneer of Bitcoin IRAs

- They offer over 20 different digital assets for inclusion in their IRAs, plus gold

- Exclusive "Earn" program lets users earn an additional 2-6% APY interest on their holdings

- Only use U.S.-based exchanges, security (Brink's), and liquidity providers (Genesis Capital)

Cons:

- Administration and storage fees are not readily available on the site

BitcoinIRA (sometimes referred to as “Bitcoin IRA”) was the cryptocurrency IRA industry’s “first mover”. That is, at the time of its launch in 2015, no other American service offered dedicated Bitcoin IRA investing services.

At the time of its launch, BitcoinIRA offered only Bitcoin and Ethereum investing services. However, in recent years, BitcoinIRA has expanded its catalog to include a diverse variety of cryptocurrency assets including Zcash, Litecoin, Ripple (XRP), Cardano, and several other key altcoins. The rapid ascent of BitcoinIRA has given the California-based company widespread media coverage in such outlets as Forbes, CNBC, and Barron’s who have applauded the company’s efforts at making self-directed cryptocurrency IRA investing accessible to more Americans than ever before.

Beginning in 2020, BitcoinIRA began diversifying its product listing to include physical precious metals. Today, BitcoinIRA users can invest in gold bullion via their proprietary platform. BitcoinIRA partners with Brink’s bullion vaults, a secure third-party precious metals custodian, to ensure that every customer’s metals are held in segregated and FDIC-insured vaults.

A key selling point of BitcoinIRA is that you can earn interest on your cash and crypto holdings. Users currently earn 2% interest (APY) on crypto assets, such as Bitcoin, loaned out through the BitcoinIRA platform. Cash holdings currently earn up to 6% APY, which is exponentially higher than the standard 0.05% that most banks currently pay out to their savings account holders. In other words, BitcoinIRA lets you build free money simply by holding your cash and crypto with them. Interest is compounded daily and paid out monthly where the payouts are reflected directly in their users’ portfolio balances.

Source: BitcoinIRA Dashboard

As seen above, the BitcoinIRA dashboard is extremely sleek and displays your portfolio balance in a neat, no-nonsense interface. From there, you can easily navigate to the buy, sell, and swap tabs to make instant trades without any hassles or headaches. The entire user interface is designed to simplify the otherwise complicated and sometimes confusing process of trading cryptocurrencies. Whereas platforms such as Binance, KuCoin, and Gemini can take hours to figure out how to use effectively, BitcoinIRA is intuitive and can be easily understood in minutes.

For a closer look at the full BitcoinIRA dashboard, here’s a screenshot of the entire screen. As seen below, there’s a taskbar at the top of the screen that lets you easily switch tabs to check live prices or make trades whenever you want. Plus, there’s a wealth of video and written resources to help you learn how to efficiently navigate their dashboard.

Source: BitcoinIRA Dashboard

Table of Contents

Bitcoin IRA Management Team

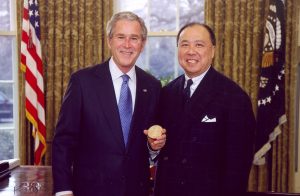

Edmund (“Ed”) Moy is BitcoinIRA’s Chief Strategist and a key executive on the BitcoinIRA team. He has been an enormous boost to the firm since his arrival in 2016. Formerly, Ed Moy served as the 38th Director of the U.S. Mint, serving in this role from 2006 until 2011 after being appointed by President George W. Bush.

Mr. Moy’s extensive academic background in political science, public education, and international relations has equipped him with a firm belief in the blockchain’s emancipatory potential as a democratic tool. Since its inception, Ed has been a major believer in Bitcoin and other cryptocurrencies as sound forms of money and stores of value. When properly utilized, he believes that cryptocurrencies can make both public and personal finance simpler, safer, and more accessible to all.

As the head of the United States Mint, Mr. Moy supervised operations during the global financial crisis and Great Recession between 2008 and 2010. This was an era where there was an unprecedented level of demand for financially sound assets such as gold and silver bullion. Cryptocurrencies such as Bitcoin, according to Ed, are assets of a similar kind given their inherent scarcity and instrumental value. Additionally, Mr. Moy oversaw the final days of the “50 States Quarter” program, as well as the launch of the Presidential Dollar Coins and the National Park Quarters program. He managed the relaunch of the Saint Gaudens Double Eagle gold coins as well. His programs were so successful that his time at the mint saw a billion dollars of surplus earnings returned to the U.S. Treasury’s General Fund during his tenure.

Before assuming the role of Chief Strategist at BitcoinIRA, Mr. Moy formerly served as an executive of Fortress Gold Group, a large provider of gold IRA accounts. Moy is also a published author of the book American Gold & Platinum Eagles, which is available on Amazon.

Chris Kline is BitcoinIRA’s co-founder and long-time Chief Operating Officer (COO). Mr. Kline is a graduate of The University of Colorado, Boulder, holding a degree in international finance. Also an executive for Fortress Gold Group, Mr. Kline’s presence at BitcoinIRA suggests that BitcoinIRA’s management team brings a wealth of experience in gold and silver investing to BitcoinIRA. The Los Angeles-based Mr. Kline has authored numerous articles and provided many interviews promoting both Bitcoin IRAs and the wealth of blockchain-enabled digital assets such as DAOs and other DeFi instruments.

Lastly, BitcoinIRA’s Chief Executive Officer (CEO) is Camilo Concha. Alongside COO Chris Kline, Chief Strategist Ed Moy, and other members of the executive team, Mr. Concha is responsible for managing the day-to-day affairs of BitcoinIRA. A member of the Forbes Financial Council, Mr. Concha is the founder of LendingUSA, a fintech solution that has processed over $2 billion in loans. His entrepreneurial accolades have been formally acknowledged by the United States Congress and the United Chamber of Commerce.

The transparency of the BitcoinIRA is a major asset for the company. In an industry shrouded by shady founders and faceless management teams, BitcoinIRA is proud to publicly acknowledge their all-American executive team and, for years, their team has evaded scandals or even mild pubic criticisms. In our books, this is a huge vote of confidence for the company and one of the main reasons why customers should trust BitcoinIRA.

Bitcoin IRA Opening Process & Account Setup

The BitcoinIRA account setup and initialization processes are fairly straightforward and in most cases take less than one minute to arrive at the dashboard. Simply visit the BitcoinIRA homepage, input your name, phone number, and email address, and immediately you will be taken to the dashboard without the need to verify your credentials—at least not yet.

There you will find a variety of panels that comprise the BitcoinIRA dashboard, including:

- Your Portfolio: A display containing the value of your cash holdings, Bitcoin, altcoins, and any pending orders outstanding.

- Knowledge Base: A variety of free video tutorials and written walkthroughs to help you navigate their platform and develop basic trading and investing skills.

- Live Prices: An up-to-the-minute feed of the trading price of Bitcoin, gold, and several leading altcoin prices in USD.

- Expert Support: An around-the-clock dedicated phone line and appointment booking portal to help with customer support and technical issues.

- Self Trading: A simple buy, sell, and swap system for facilitating cryptocurrency transactions.

After setting up your account, you can choose to instantly apply for either a Roth IRA (consisting of after-tax dollars) or a Traditional IRA (consisting of pre-tax dollars).

BitcoinIRA’s customer support representatives, in our experience, were friendly and provided some simple and accurate advice when we played dumb and asked if we should open a Roth or Traditional account. In short, if you expect your taxable income to increase in the future (and especially by retirement age), then you’re likely better off with a Roth IRA.

At this stage, you can also choose with custodian you would like to work with. Since BitcoinIRA only works with trusted US-based administrators, it likely doesn’t matter which custodian you choose since all of them are secure and reputable.

Funding Your Account

To fund your account, click the blue “Start Now” (or similarly named) button within the orange top-left dashboard panel. This button will take you to a sign-up wizard that gives you two primary funding options, detailed below.

- “Transfer from a retirement account”: This process initiates an IRA or 401(k) rollover from an existing employer-sponsored account into a new account administered by BitcoinIRA.

- “Transfer from a bank account”: This process uses cash deposited directly from your private bank account and does not involve any existing retirement account funds.

No matter which option you take, the fees are the same and the total amount of time required (i.e., 2 to 5 business days) is usually similar as well. You’ll also be prompted about whether you want to opt-in to BitcoinIRA’s “Interest Earning Program” whereby you can earn up to 6% interest on your holdings. If you intend to hang onto your investments without selling or trading coins valued at $10,000 USD for at least a year or longer, we recommend taking this option.

At the next stage, you will be prompted to input sensitive information such as your Social Security Number, marital status, date of birth, and either your banking information or your existing retirement account details. Don’t stress about whether this identifiable information will be compromised since BitcoinIRA uses SSL encryption security protocols and in its many years of existence has never been subject to a hack or data breach.

BitcoinIRA Interest Earning Program: Is It Legit?

BitcoinIRA’s Interest Earning Program (or “Earn” program) was introduced in 2019 and has so far been a shining example of how to model a “high-interest savings account” style of Bitcoin investing. It works fairly simply, in that cryptocurrency holdings valued at $10,000 USD or more can be temporarily entered into BitcoinIRA’s investment fund (in collaboration with Genesis Global Trading Inc.).

As of late-2020, Genesis and BitcoinIRA lend approximately $3.4 billion worth of cryptocurrency through their active loan portfolio. The deposits from BitcoinIRA users who opt into the Interest Earning Program help fund this loan portfolio which, in turn, earns 6% interest for the depositors.

There’s no denying that BitcoinIRA’s Interest Earning Program is a legitimate program that works as advertised. After using the service for three months, we found that our holdings returned exactly 6% interest on their initial value each month. By the way, that interest rate is on top of the impressive returns that our Bitcoin generated in that time as the price of Bitcoin naturally rose relative to the US Dollar.

You can withdraw your deposit at any time. However, only cash, Bitcoin, and Ethereum (again, valued at at least $10,000 USD) are eligible for inclusion in the program.

There is a $100 fee to close your position in the program, as well as a $100 fee to open your position. These fees, of course, pale in comparison to the interest earned on your investment. Even a minimum deposit of $10,000 USD would earn $600 in interest within a single year; enough to cover both fees three times over.

How Does BitcoinIRA Store Your Cryptocurrencies?

We’re often asked about BitcoinIRA’s storage system. The answer, in short, is that it’s a bit of a black box. Personally, we would have preferred if BitcoinIRA was a bit more transparent about their storage protocols but, given that they have a perfect track record of security, they must be doing something right.

According to BitcoinIRA’s website, the company utilizes a “three-layer security system” that includes a multi-signature digital wallet. It’s probable that this involves some combination of cold storage, offline hardware storage, and web-based solutions.

All of BitcoinIRA’s storage protocols are handled by BitGo, an American digital asset trust company. BitGo specializes in qualified, insured cold storage for digital assets and works primarily with large enterprise clients and financial institutions to ensure that their clients’ assets are kept safe. Since its founding in 2013, BitGo has never experienced a security breach.

BitcoinIRA Company Products

BitcoinIRA sells a variety of major cryptocurrency products, including the lion’s share of the world’s largest altcoins by market capitalization. Below are the marquee digital assets currently on offer by BitcoinIRA:

- Bitcoin

- Ethereum

- XRP

- Solana

- Stellar

- Litecoin

- Algorand

- More than a dozen other altcoin tokens

Other interesting blockchain projects such as Polkadot (DOT), Cardano (ADA), Dogecoin (DOGE), and Chainlink (LINK) are also currently supported by BitcoinIRA. It remains to be seen, however, how BitcoinIRA plans to integrate DAO or Metaverse projects into their product ecosystem in the future, if at all.

Beyond digital assets, BitcoinIRA has more recently expanded its product line into the world of precious metals investing. Whereas BitcoinIRA was once limited to digital assets, the company now allows customers to purchase IRA-eligible gold coins and bullion on the condition that it is vaulted by a trusted third-party custodian (i.e., no IRA-included metals can be held privately by the account holder himself/herself).

It’s also worth noting that BitcoinIRA doesn’t only offer IRAs to their customers. If you sign up for a retirement account with BitcoinIRA, you can alternatively choose to invest with a Bitcoin 401(k) or a Bitcoin Roth IRA. Any account type is free to hold a mix of digital assets and gold.

BitcoinIRA Reviews, Ratings, and Complaints

Below is a list of reviews and complaints that you will find on trusted reporting sites and rating agencies. There are links provided for each which will let you read verified reviews in greater detail.

- BCA Rating: “AA” Company Rating

- BCA Complaints: 0 registered complaints (Details)

- BBB Rating: ⭐⭐⭐, (“A+” and 2.6 Star Rating based on 5 Customer Reviews)

- BBB Complaints: 3 complaints closed in the last 3 years

Company Contact Information

- Address: 15303 Ventura Blvd, Suite 1060, Sherman Oaks, CA 91403

- Phone: 877-430-3546

- Website: www.bitcoinira.com

- Opening Hours: Monday-Friday: 8 am-5:30 pm PST

Ready to Get Started?

Considering taking the next step in your cryptocurrency IRA journey? If you’re new to Bitcoin investing and want to take advantage of a 24/7 online trading platform that won’t confuse you with technical charts or complex algorithms, BitcoinIRA might be right for you.

At Sophisticated Investor, we recommend giving BitcoinIRA a shot if you’re interested in Bitcoin investing within a tax-advantaged retirement account. This is especially true if you have more than $10k USD with which to invest, given the 6% APY you can rake in without spending a dime (or, rather, a satoshi) of your digital wealth through BitcoinIRA’s Earn Program.

Haven’t quite made up your mind? Feel free to browse our complete list of Bitcoin IRA company reviews to find a service provider that matches your needs.

(Note: Do you represent BitcoinIRA? To contact our reviewers about the ratings and commentary provided in this article, please use this secure contact form.)

- Phone : +1 877 936 7175

- URL :

- Global Rating

- Very Good

User Rating

- 3 Reviews

Launched in 2015, BitcoinIRA was the world’s first full-service Bitcoin IRA investing solution in the United States. Today, retirement investors interested in self-directed cryptocurrency trading and investing within an IRA can take advantage of BitcoinIRA’s 24/7 online platform and app—all within a low fee structure and a sleek user interface.